Non-Resident Indians (NRIs) are among the biggest investors in the UAE. The UAE is the top destination country for Indian migrants, with an NRI population of approximately 3.5 million. NRIs who are planning their financial futures are often faced with a difficult question: should they invest in dollar-denominated investments in the country where they live or send money back home to India? The loyalty many NRIs feel toward their ancestral homeland, combined with a desire to invest in “local” Indian investments—in particular, property, life insurance, or Fixed Deposits—make this a difficult decision.

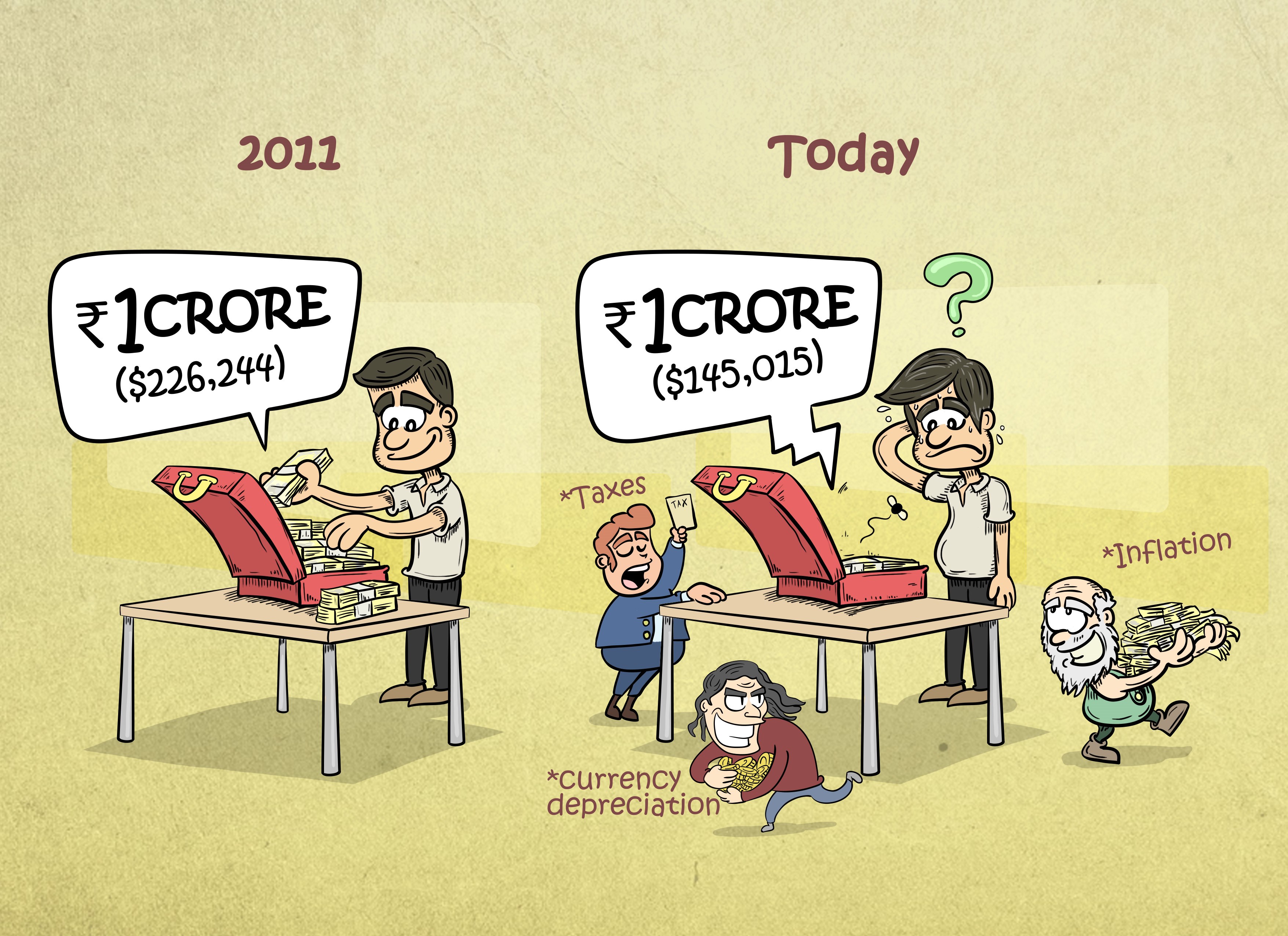

One challenge with local investment in India is that the Indian rupee (INR) has fluctuated significantly in recent years, with a continual downward trajectory: the rupee has lost approximately 41% of its value against the dollar since its height in 2011, for an average depreciation of more than 5% per year. For that reason, it is sensible to diversify into a dollar-denominated global investment strategy.

The purpose of diversification is to guard against risk. Diversification protects the investor because if one investment loses money—whether through depreciation, stock market fluctuations, or other market conditions—that loss is more likely to be offset or minimized by the performance of other investments. To that end, there are several advantages to dollar-denominated investments that make them a worthwhile addition to a well-diversified portfolio.

One significant benefit of dollar-denominated investments is that they are a stable hedge against the depreciation of the Indian rupee.

How significant is the difference? Had you purchased an insurance plan for 1 crore rupees in 2011, when the rupee had an exchange rate of Rs.44.2 to one U.S. dollar, your insured amount would have been the equivalent of US$226,244 in 2011. But the current value of that plan would be just US$145,015—a depreciation of nearly 36%. By contrast, if you had purchased a U.S.-dollar denominated policy for US$226,244 in 2007, its current value in INR would be Rs.15,601,597.

Dollar-denominated insurance and investment products are also easily transportable anywhere in the world. Most insurance plans offered in the UAE are based offshore, and will continue to cover the insured during foreign travel or after permanent international relocation. This reduces costs because investors can retain the same investments throughout their lifetimes, without the need for currency conversion or the purchase of a new product upon relocation to a different country. As well, these investment products are generally shielded from the restrictions that might be imposed by Sharia law and the somewhat non-traditional requirements necessitated by the rules of Islamic finance.

Dollar-denominated investments have proven stable in present times of regulatory uncertainty. The financial crisis of 2007–2008 led to an increasingly complex global regulatory landscape. While there has been a push for deregulation, many investors have looked with skepticism upon investment products denominated in fluctuating currencies in emerging markets, fearing such investments may prove unstable and lead to further crises. By contrast, the U.S. dollar has never been devalued and its notes have never been invalidated.For this reason, the dollar is the unofficial “global currency,” and comprises more than 60% of all known central bank foreign exchange reserves worldwide.

Stability and transportability help explain how dollar-denominated investment and insurance products facilitate a faster claims process: these products are less prone to foreign-exchange fluctuations, making valuation, calculation, and payout of claims a simpler and more efficient process. As well, UAE-based insurance providers have many years of experience processing and paying out claims in foreign countries, streamlining the claims process even further.

If healthcare is of particular concern, insurance plans purchased in the UAE have a more broadly-defined scope of critical illness coverage than most Indian insurance plans, the terms of which are often either restrictive or vaguely-defined (or both) and easily prone to interpretations leading to denial of coverage. As discussed above, the portability of dollar-denominated plans means it will be easier for you to access high-quality medical care, whether in the UAE or anywhere else in the world, should you need to seek treatment for critical illnesses.

Finally, the dollar is an optimal currency for investments designed to secure your family’s financial future. If you are budgeting for long-term expenses such as the education of children, life insurance, the payment of long-term debt liabilities such as mortgages and business loans, re-location/immigration expenses, or retirement, the dollar’s stability and global acceptance make it an ideal currency for investment in long-term assets.

* * *

If you’re interested in learning more about how dollar-denominated investments and insurance can play a part in securing your financial future, Continental Group has a broad geographical footprint and an international network of customer support services. Our experienced investment advisers can explain the full range of investment and insurance options available to NRIs in the UAE and elsewhere. To request a free consultation today, visit www.cfsgroup.com/contact.