The FIRE number — abbreviation for financial independence, retire early — is the amount of money or investments that a person needs to quit working and continue the existing lifestyle through the returns. So, FIRE number is the determinant of your financial freedom without the hassle of holding onto a job that you may or may not like. So, with notions of the 60s as the retirement age becoming increasingly archaic, people across age groups are displaying interest in calculating their FIRE numbers.

The FIRE movement, which is particularly popular among millennials, encourages saving and investing as much as possible during the 20s and 30s and retiring way before the age of 64. This movement has gathered momentum lately in response to the challenges posed by an increasingly competitive and strict corporate work culture. Millennials, harbouring different priorities and placing their personal needs above all else, are seeking respite from the corporate world. Their vision of living life on their own terms rather than submitting to pressure has snowballed into a movement.

Many people, particularly millennials, have come out of the pandemic with new priorities geared towards financial independence.

Furthermore, during the peak COVID-19 pandemic, remote work gave many people a glimpse of flexibility, enabling them to subscribe to the idea of early retirement and plan their finances around it. Many people, particularly millennials, have come out of the pandemic with new priorities geared towards financial independence. If these priorities resonate with yours, then calculating your FIRE number is perhaps the best way to start.

Calculating your FIRE number

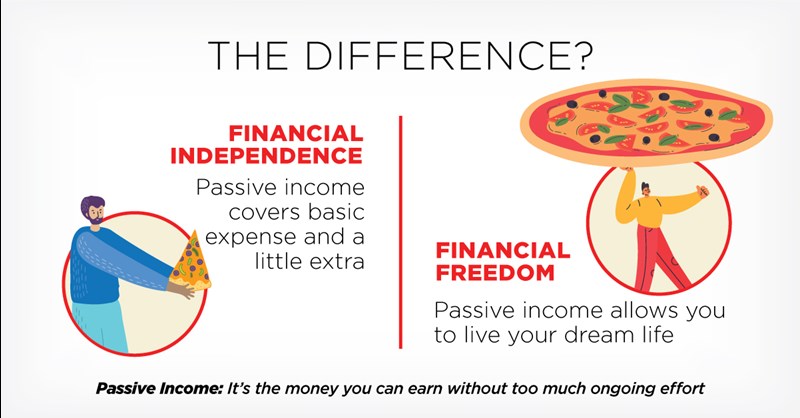

The core tenet is to save and invest between 30-60% of your annual income in assets that can generate passive income and large returns over time.

The basic rule to start saving for early retirement is to initiate the process at the earliest. Simultaneously, while you're saving, you should make strategic investments so that you can achieve incremental ROI. Since FIRE is based on the idea that retirement is determined by money rather than a person's age, you can start planning at any stage of your career. The core tenet is to save and invest between 30-60% of your annual income in assets that can generate passive income and large returns over time. These investments can be in stocks, bonds, index funds, exchange-traded funds (ETFs), real estate, gold, or cryptocurrencies even.

To determine your FIRE number, start by evaluating your annual expenses. Next, calculate how much money you must save periodically to generate the capital that will allow you to sustain without taking a job. According to a rule of thumb, retirees can comfortably withdraw about 4% of their savings each year without running out of money. This indicates that if you save 25 times your current yearly expenses, you can continue spending forever with 4% annual withdrawals.

For instance, if your monthly spending is $4,000, your annual expenses total $48,000. So, your FIRE number equals $48,000 multiplied by 25, equivalent to $1.2 million. Additionally, there is another way to compute your FIRE number, using the following formula:

Annual costs / 0.03 = FIRE Number

The researchers found that someone with at least 50% equity in their wallet had a 100% chance of safely withdrawing 3% of their money for 40 years without losing their investment.

This second formula is based on a recent Trinity University research. Using historical market data, the professors examined sustainable withdrawal rates based on various stock and bond allocations for different retirement prospects. The researchers found that someone with at least 50% equity in their wallet had a 100% chance of safely withdrawing 3% of their money for 40 years without losing their investment.

Get to the magic number

Many people believe they do not earn enough money to retire early. However, there are numerous approaches that can help individuals retire sooner than they imagine. When you decide to retire early, you should be prepared to make significant lifestyle changes. These adjustments could be as substantial as additional income streams or as minor as cutting your hair. It ultimately boils down to either slashing your spending or increasing your savings, or both.

One of the simplest ways to accomplish this is to reduce spending and adopt a relatively simpler lifestyle. This is referred to as “Lean FIRE”, which involves setting a modest goal and living accordingly in retirement. Conversely, earning a higher income, acquiring in-demand skills, or starting a side business are some of the strategies to reach “Fat FIRE”. Those who follow Fat FIRE will have to work in high-paying jobs to reach their savings target.

Furthermore, people who desire to retire sooner can use a method known as “Barista FIRE”, which enables them to stop their job once they have accumulated enough retirement funds. Rather than quitting their careers, they can work part-time in low-paying jobs or on their own projects to cover basic living expenses while their long-term retirement assets grow and become substantial.

While it is vital to save or invest in various asset classes for early retirement, it is also important to consult with a financial advisor to ensure that your pursuits do not backfire. Advisors are best equipped to provide you with a holistic picture of the various possibilities/opportunities available to you and guide you to develop an effective investment strategy.

Connect with us, please write to us at clientservice@cfsgroup.com